RBI cuts repo rate by 25 bps amid benign inflation, focusing on liquidity and growth

#

5th Dec, 2025

- 2132 Views

NDNC disclaimer: I hereby authorize Bajaj Life Insurance Limited. to call me on the contact number made available by me on the website with a specific request to call back. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) or on National Do Not Call Registry (NDNC), any call made, SMS or WhatsApp sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business

Comments from Mr. Srinivas Rao Ravuri, Chief Investment Officer, Bajaj Life Insurance

RBI Reduces Policy Rate Amid Multi Year Low Inflation

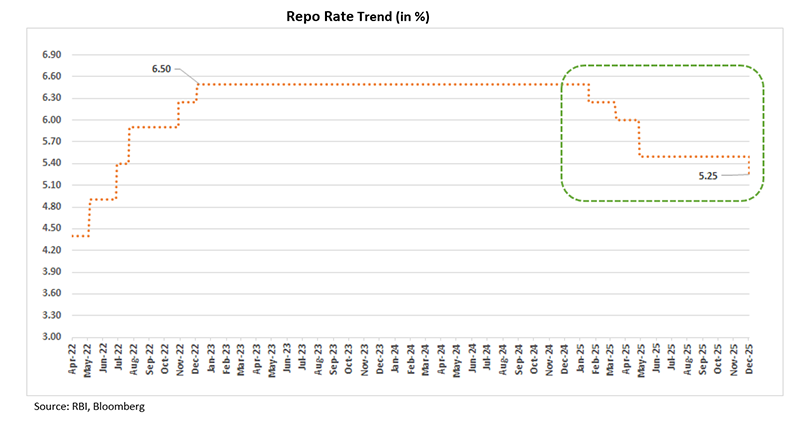

The RBI’s Monetary Policy Committee (MPC) unanimously cut the repo rate (the rate at which RBI lends to Banks) by 25 basis points, bringing it down from 5.50% to 5.25%. Cumulatively, RBI has cut 125 bps since Feb’25 so far. With most consumer loans including home loans are linked to the repo rate. This means the latest rate cut will pass through more quickly to borrowers, helping lower EMIs and support consumer demand.

The MPC also decided to continue with a neutral stance, giving the RBI flexibility to act depending on future growth and inflation trends. This rate cut comes as inflation continues to soften and economic risks remain mixed. The Governor highlighted that the central bank aims to support the economy while keeping long-term stability in focus.

Growth: Domestic Activity Holds Up but External Risks Remain

India’s economy recorded a strong performance earlier in the year, supported by GST rationalization, festival-season demand, and steady investment activity. Rural demand stayed firm due to good kharif output, while urban consumption improved gradually. High-frequency indicators point to stable momentum in Q3, though certain industrial segments showed pockets of weakness. The RBI projects GDP growth at 7.3% for FY2025-26, with Q1 & Q2 FY27 quarterly growth at 6.7% and 6.8%. The central bank highlighted that while domestic factors are supportive, global uncertainties—especially trade tensions and slower external demand—continue to pose risks to the growth outlook.

Inflation: Sharp Decline Led by Food Prices

Headline CPI inflation dropped to an all-time low in October 2025, mainly due to falling food prices and better supply conditions. Inflation is now expected to stay below 4% for most of FY2025-26. The RBI revised its inflation outlook as follows:

• FY2025-26 inflation: 2.0%

• Q1 & Q2 FY26-27: 3.9% and 4.0%, respectively

Underlying inflationary pressures remain low, with the main upside risk coming from precious metals and global supply disruptions. Overall, risks are considered evenly balanced.

Liquidity and Transmission: Supportive Conditions with Fresh Liquidity Measures

System liquidity stayed in surplus, averaging ₹1.5 lakh crore since the last policy meeting. To ensure smooth system liquidity and policy transmission, the RBI announced additional measures for December, including an OMO purchase of ₹1,00,000 crore and a USD/INR buy–sell swap of USD 5 billion, which together will inject durable liquidity into the banking system. Transmission continues to improve — since February 2025, lending rates on fresh loans have fallen by 69 bps, and deposit rates have softened by 105 bps.

External Sector: CAD Narrows and Services Exports Stay Strong

India’s current account deficit fell to 1.3% of GDP in Q2 FY2025-26 due to strong services exports and remittance flows. Merchandise exports declined due to weak global demand, widening the trade deficit. FDI inflows increased, but net FDI moderated on account of higher outbound investments. Portfolio flows remained weak due to global financial conditions. With foreign exchange reserves at USD 700 billion-plus, India continues to hold over 11 months of import cover, providing a strong buffer against global volatility.

Financial Stability: Banking System Strengthens Further

The banking sector remained stable with strong capital adequacy, liquidity, and asset quality. Scheduled Commercial Banks continued to show improvement in gross and net NPA ratios, while NBFCs also remained well-capitalized. Credit growth to industry strengthened, supported by better flow of funds to MSMEs and large corporates. The overall flow of resources to the commercial sector improved compared to last year.

Additional Measures: Focus on Customer Service and Financial Inclusion

The RBI announced several steps aimed at improving customer service and strengthening financial inclusion. These include faster grievance redressal under the RBI Ombudsman framework, publishing monthly timelines for how quickly service requests are resolved, and improving digital access to various RBI services. Together, these measures are designed to increase transparency, enhance customer experience, and build greater trust and confidence in the financial system.

Outlook: RBI Prioritises Growth and Liquidity; Future Rate Moves Will Depend on Data

The policy outcome was broadly in line with market expectations. The overall policy tone was balanced, though slightly cautious. The RBI’s emphasis on growth and adequate liquidity in the banking system. The Governor’s Statement highlights that recent liquidity measures, including OMO purchases and the USD/INR buy–sell swap to ensure smooth financial conditions and better transmission of earlier rate cuts.

Inflation has been extremely benign, supported by stable food supplies, lower input costs, and easing global price pressures. The RBI expects this favourable trend to continue. With inflation well under control, the policy environment now allows the central bank to concentrate more on supporting growth and improving monetary policy transmission, rather than considering higher interest rates.

On the currency front, the RBI noted that the INR/USD has been volatile, driven mainly by global factors such as interest rate expectations and capital flows. The RBI reiterated that it does not target a specific rupee level but will step in when needed to prevent excessive volatility. Some volatility is expected to continue, and the RBI appears comfortable with a flexible exchange rate as long as movements are orderly.

The RBI will closely watch domestic growth momentum, inflation trends after reaching multi-year lows, and global risks — especially U.S. policy moves and trade developments. Since the effect of earlier rate cuts is still unfolding, the central bank is likely to wait for clearer signs before making additional policy changes.

We believe 10-year G-Sec yield to remain in a narrow band of 6.30%–6.50%. In the current environment, we continue to prefer 3–5-year corporate bonds along with 30-40 year (longer end) of government securities.

Annexure:

CRR – The share of a bank’s total deposits that must be kept with the RBI in cash.

Stance – It gives an indication to the future policy action.

SDF – The rate at which Banks lend to RBI without collateral.

MSF –The rate at which RBI lends (provides emergency liquidity) to Banks.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More