Steady Budget: Driving Growth through Fiscal Discipline and Sustained Capex

#

1st Feb, 2026

- 1120 Views

NDNC disclaimer: I hereby authorize Bajaj Life Insurance Limited. to call me on the contact number made available by me on the website with a specific request to call back. I further declare that, irrespective of my contact number being registered on National Customer Preference Register (NCPR) or on National Do Not Call Registry (NDNC), any call made, SMS or WhatsApp sent in response to my request shall not be construed as an Unsolicited Commercial Communication even though the content of the call may be for the purposes of explaining various insurance products and services or solicitation and procurement of insurance business

The Union Budget for FY 2026-27 serves as a strategic blueprint for India’s transition into a developed nation ("Viksit Bharat") by 2047. By balancing a sustained capital outlay with disciplined fiscal targets, the government aims to strengthen macroeconomic stability while driving aggressive growth in infrastructure and manufacturing.

The "Three Kartavyas" Framework

The budget is structured around a "Three Kartavyas" (Duties) philosophy designed to drive comprehensive national development:

1. Accelerate and Sustain Growth: Enhancing productivity and building resilience against global dynamics.

2. Fulfilling Aspirations: Building citizens’ capacity through education, skilling, and healthcare.

3. Inclusive Participation: Ensuring resources reach every family and region

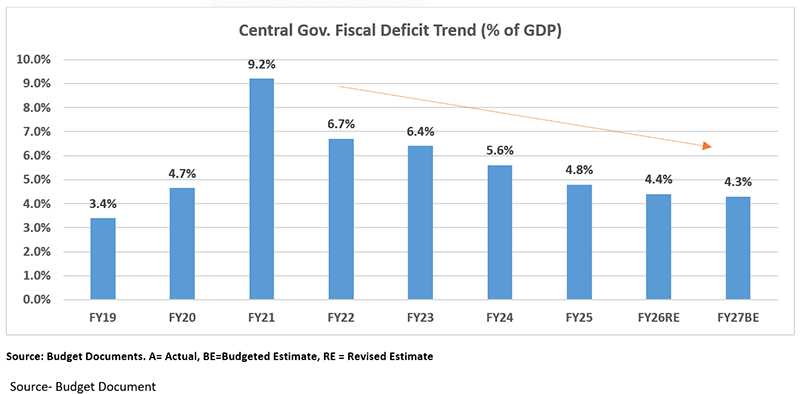

Fiscal Consolidation Continues

The government has maintained its steadfast path of fiscal consolidation, setting the fiscal deficit target at 4.3% of GDP for FY 2026-27, which marks further improvement from the estimate of 4.4% for FY26RE. The government is also working towards lowering its total debt as compared to the size of the economy. The goal is to bring this debt down to 50% of GDP by FY31. This year, they expect to make progress by reducing it to 55.6% vs 56.1% last year.

To support this comprehensive development framework, the budget outlines borrowing and expenditure plan for the upcoming fiscal year. The Gross Market Borrowing is estimated at ₹17.2 lakh crore, while the Net Market Borrowing has been set at ₹11.7 lakh crore. These figures underpin a total projected expenditure of ₹53.5 lakh crore, up 7.7% compared to FY26RE of ₹49.6 lakh crore. Net tax receipts are anticipated to reach ₹28.7 lakh crore up from ₹26.7 lakh crore in FY26RE. The 7.2% growth estimate for net tax collections in FY27 appears credible as it is even lower than the 10% increase in nominal GDP growth expected in FY27.

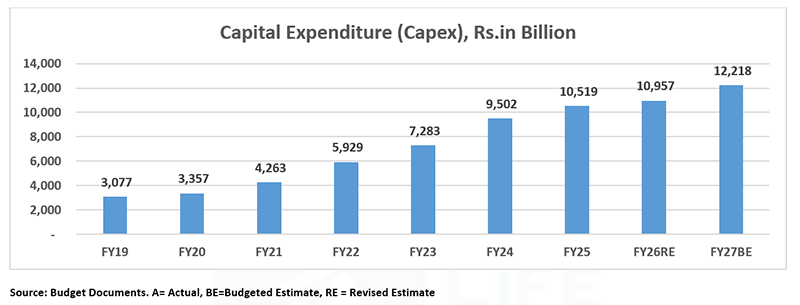

Capital expenditure

In the Union Budget 2026-27, the government has further accelerated its infrastructure-led growth strategy by increasing public capital expenditure (capex) to a record ₹12.22 lakh crore for FY27. This represents an 11.5% increase over the previous year’s revised estimates. Key drivers for this outlay include a significant ₹2.8 lakh crore (10% up compared to previous year) allocation for Railways—supporting the development of seven new high-speed rail corridors—and ₹2.9 lakh crore for Roads and Highways. Additionally, new financial frameworks like the Infrastructure Risk Guarantee Fund and dedicated REITs for recycling CPSE assets have been introduced to boost private developer confidence and sustain long-term investment momentum.

Defence Spending

The total allocation for defence increased by ~5% to reach ~₹6 lakh crore. A significant portion of this budget is dedicated to the Capital Outlay on Defense Services head, which has been pegged at ₹2.19 lakh crore. This represents a sharp 17.6% jump in modernization funds compared to the previous year.

The strategic focus of this expenditure is clearly defined by large-scale allocations for high-tech hardware. Specifically, the budget earmarks ₹63,733 crore for the acquisition and maintenance of aircraft and aero engines, while ₹25,023 crore has been allocated for the strengthening of the naval fleet and enhancing the operational readiness of the armed forces across air and maritime domains.

Taxation and Compliance

While personal income tax slabs remained unchanged for FY 2026-27, the government has introduced reforms to simplify India’s tax landscape, including a new Income Tax Act, 2025, which reduces sections from 819 to 536 for easier compliance. Key changes include slashing Tax Collected at Source on overseas remittances from 5–20% to a flat 2%, taxing share buyback proceeds as Capital Gains. The budget also provides a one-time 6-month window for small taxpayers and NRIs to disclose minor foreign assets without heavy penalties.

Capital Markets and Sectoral Impacts

For investors, the budget introduced several critical changes that are likely to impact trading costs and capital flows:

• STT on F&O: To curb excessive speculation, the Securities Transaction Tax (STT) on Equity Futures was hiked to 0.05% (from 0.02%), and on Equity Options to 0.15% (from 0.1%) of the premium value.

• NRI/PROI Investment: Individual investment limits for Persons Resident Outside India (PROI) in listed equities were doubled from 5% to 10%, with the aggregate cap per company raised to 24%.

• Buyback Taxation: In a move favouring minority shareholders, buybacks will now be taxed as Capital Gains in the hands of the shareholder, while promoters face an additional buyback tax.

• MAT Overhaul: Minimum Alternate Tax (MAT) is proposed as a final tax with a reduced rate of 14% (down from 15%), with no further credit accumulation after April 1, 2026.

Key Highlights

The budget had specific measures that will go a long way in improving India’s physical and technological Infrastructure

• Biopharma SHAKTI (Strategy for Healthcare Advancement through Knowledge, Technology and Innovation) announced, with an outlay of ₹ 10,000 crores over the next 5 years to develop India as a global Biopharma manufacturing hub.

• AI and Cloud: A tax holiday until 2047 was proposed for foreign companies providing global cloud services via Indian data centres.

• High-Speed Rail: Seven new corridors were announced, including Mumbai-Pune, Pune-Hyderabad, and Delhi-Varanasi.

• Inland Waterways: Plans to operationalise 20 new national waterways over five years and develop ship-repair ecosystems in Varanasi and Patna.

Conclusion

Though the measures announced in today’s Budget are unlikely to have meaningful impact on any sector in the near term, it makes a calculated shift from short-term populism to long-term nation-building. By anchoring the economy with a 4.3% fiscal deficit target for FY27 along with sustained investments in capital expenditure, the government has provided a predictable and stable environment for investors. The budget math appears credible with modest estimates of tax receipts and expenditure. Ultimately, this budget reinforces India’s trajectory as a resilient pillar of global economic growth. Overall, in our assessment, the budget is positive from medium to long term prospective.

Enter your email address to subscribe to this blog and receive notifications of new posts by email.

Facebook

Twitter

pintrest

instagram

Whatsapp

Linkedin

More